Books of Interest

Website: chetyarbrough.blog

48 Laws of Power

Author: Robert Greene

Narration by: Richard Poe

Robert Greene (American author, wrote seven international bestsellers, received his degree from University of Wisconsin-Madison in classical studies.)

This is a long book that shows a breadth of understanding about the history of power. How power and influence is acquired and wielded by human beings. Power and influence ranges from idealism to pragmatism to nihilism. In some sense, the “48 Laws of Power” is a study of emperors, courtiers, generals, con artists, and others who acquired power over others in history. What Greene reflects on is the social and human art of gaining and wielding power over other human beings. Whether one is low or high in the hierarchy of humanity, the general key to having power according to Greene is “never outshine superiors” but “always court attention that gains either respect, influence, or control of others”.

Greene brilliantly summarizes many characteristics of leaders in history to support his fundamental beliefs about power. He suggests all humans are primarily self-interested. One may disagree with that belief as a universal truth because there are many examples of social cooperation to achieve a common good or a stable system of governance. However, there is always a prime mover, a powerful person behind the scenes who drives the effort to succeed or fail.

Greene argues power is the result of interpersonal relationships. There is a great deal of truth in Greene’s analysis of power but from an institutional or organizational point of view, power is spread among departments’ leaders who report to a single leader. This is not to contradict Greene’s examples of interpersonal power but to temper belief that all power rests with one wielder of power. There is a great deal more to power than individual human manipulation. Organizations of the modern world are built around individual departments with singular powers beyond singular organizational leaders.

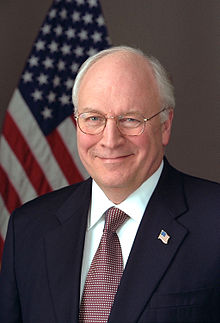

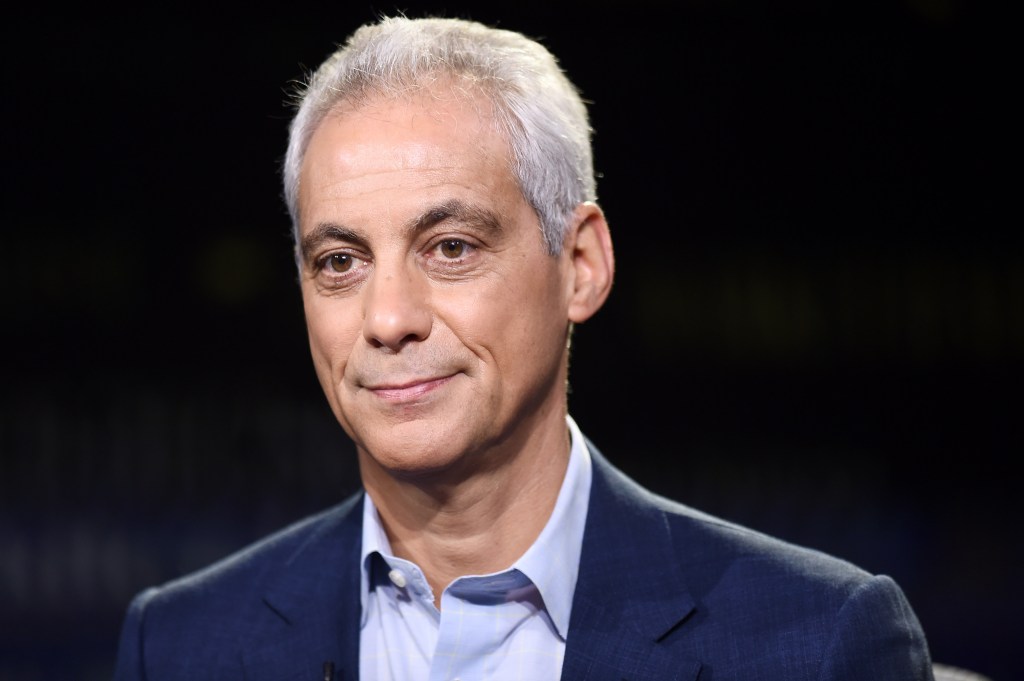

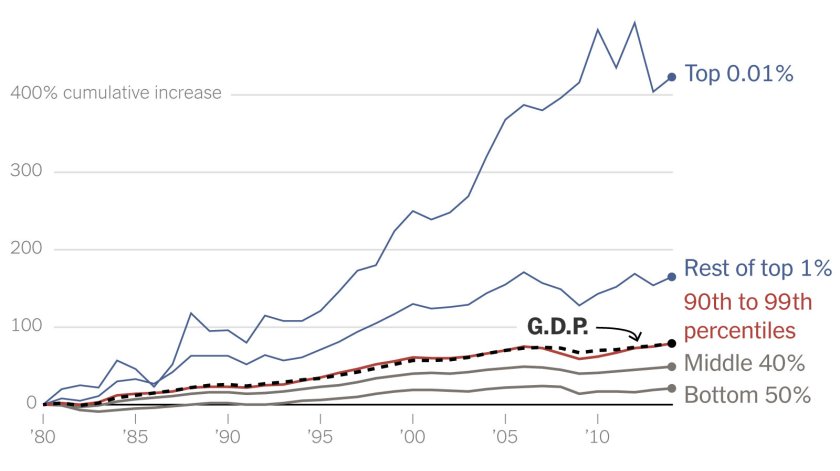

American Capital.

To give an example: regardless of who is President of the United States, there are Constitutional and legal systems that constrain his/her power. The bureaucracy of governance operates within rules set by law and precedent. In the case of business enterprise, shareholders, boards, and regulatory frameworks diminish the power of its executives. Further, even in the marketplace of business, capital limitation, supply chains, national platforms like Google, Amazon, and credit card companies have major influences on power exercised by any singular entity. Power in every human organization is also influenced by religions, social myths, and societal norms.

In this increasingly interconnected world, power has become impersonal, sometimes structural and emergent in ways that are non-intentional but significantly more powerful than one individual.

The weakness of the “48 Laws of Power” is that it fails to address institutionalized power that multiplies the power of individuals. A leader of a government or corporation works within a framework of historically developed departments that have their own powers and influences on public and private functions. The dynamics of power Greene explains apply within departments of government and corporations that go beyond the power of one leader.

This often leads to unintended consequences. ICE and Trump’s power are a current example of unintended consequence because of the murder of two Minneapolis American citizens who demonstrated against the President’s immigration policy. One doubts that the President of the United States wishes for the murder of American citizens who disagree with his immigration policies. However, power of the individual still matters as is demonstrated by today’s American President. Greene precisely explains how one person gains power over another despite a modern world that complicates individual power.

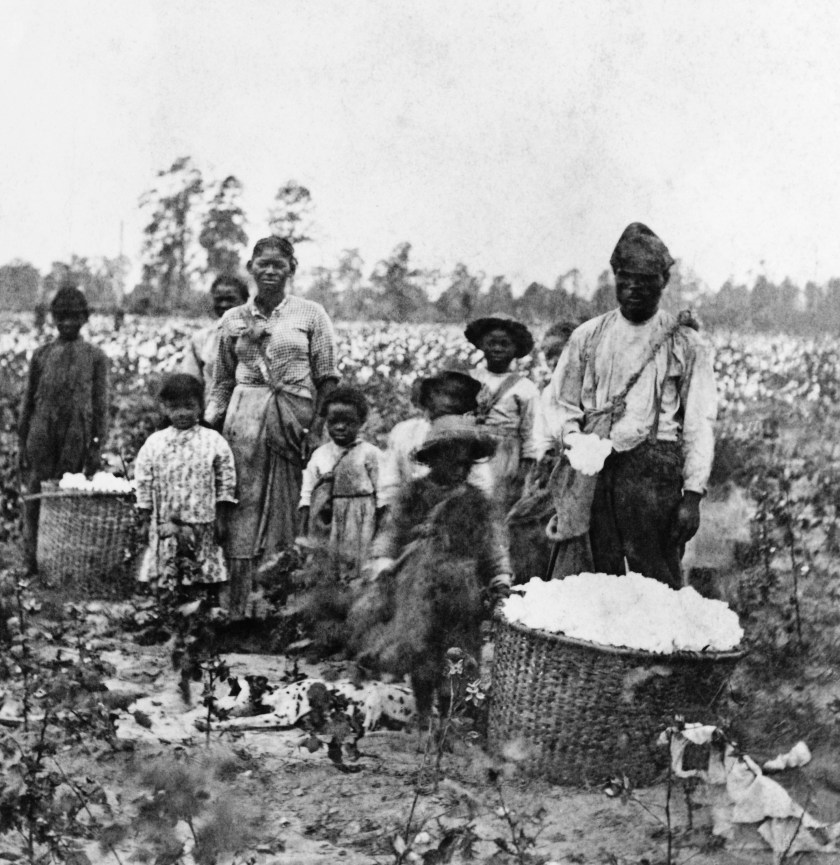

ICE murder of American citizens in Minneapolis who are protesting Trump immigration policy.

President Trump demonstrates his power over education, government employment, health and human services, birth control, and immigration policy. However, both good and bad government policy is magnified by Departments of Government that report to the President, i.e., bad policy coming from a President’s power is only made worse through implementation by subordinates who create their own power structures.

It is not that Greene’s analysis of power is wrong but that it applies to individual relationships without addressing distortions of power exercised by departments of business and government that have developed their own hierarchies of power.

One doubts any President of the United States who orders elimination of illegal immigration wishes to have ICE agents murder American citizens. This is not to absolve President Trump but to suggest the ICE employees on the ground bare the weight of two unjustified murders in Minneapolis.

Greene’s explanation of power is spot on, but it is about every person’s rise to power, not the reality of one leader’s power. Organizations are made up of many other managers using the same laws of power as their presumed superior. The end result is a level of unintended consequence. Or as Lord Acton noted: “Power tends to corrupt, and absolute power corrupts absolutely”. President Trump exemplifies that truth.