Books of Interest

Website: chetyarbrough.blog

King of Kings (The Iranian Revolution: A Story of Hubris, Delusion and Catastrophic Miscalculation)

Author: Scott Anderson

Narration by: Malcolm Hillgartner & 1 more

Scott Anderson is a novelist and veteran war correspondent. His previous novels include Moonlight Hotel and The Man Who Tried to Save the World.

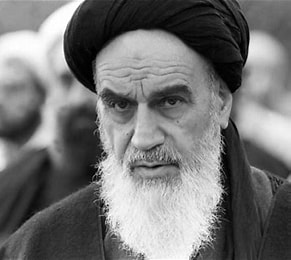

The antipathy America has about the Ayatollah’s takeover of Iran is exemplified by the young followers of his rule who chose, on their own, to attack the American embassy in Iran and take representatives of the United States as political hostages. Initially, the Ayatollah rejected the hostage taking but began to see its potential for dealing with the American government.

On November 4, 1979, 66 Americans were seized, 13 were released early, 1 was released later. That left 52 Americans that were held for 444 days. None were killed but were physically and psychologically abused during their captivity in Iran.

Anderson tells the story of Marine Corps Colonel Charles “Chuck” Scott’s as the most openly defiant, confrontational, and unbowed of the American hostages. His lifetime of military service gave him the strength to show no weakness and to refuse the students hypocritical abuse of their power over him. He became a respected and undoubtedly feared captive of the students. Scott was a symbol of calm for the hostages, some of which were overwhelmed by their imprisonment.

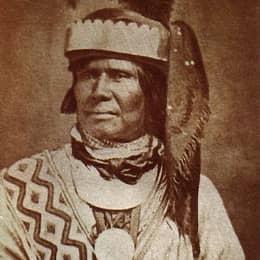

Colonel “Chuck” Scott–died at age 90 in 2023.

Anderson characterizes the hostage crisis as America’s misperception of the religious-populist character of Iran which seems as true today as when the Shah of Iran was deposed. President Trump’s decision to bomb Iran is a clear example of America’s continuing misperception of the complexity of Iranian society.

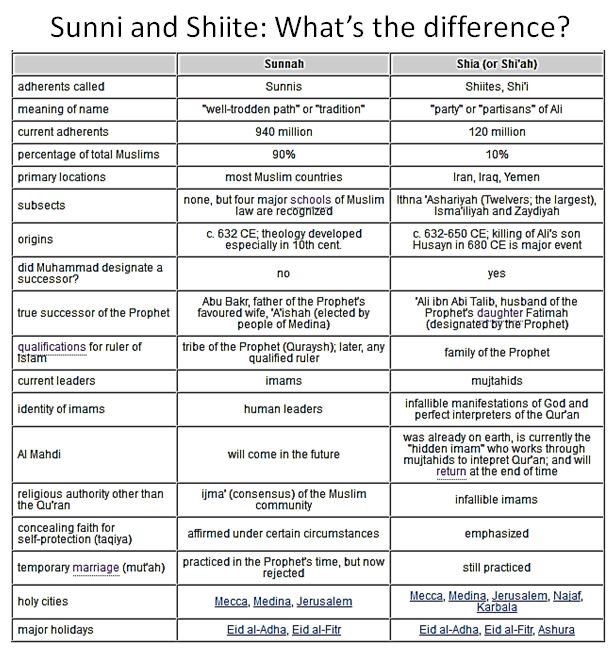

The split among the Iranian people about domestic life and religion is only magnified by America’s failure to understand Iranian culture.

Bombing will not resolve social differences in Iran. Like Colonel Scott’s reaction to being imprisoned by Iran, America must be steadfast in its resistance to Iran’s religious zealotry and deal with whatever actions taken by Iran that directly harm American interests. The killing of innocent Iranians is no answer to a government that cannot resolve conflicts in their own society.