Books of Interest

Website: chetyarbrough.blog

“Capitalism in America” (A History)

By: Alan Greenspan, Adrian Wooldridge

Narrated by: Ray Porter

As one would expect, “Capitalism in America” begins with the British economist, Adam Smith, who defined capitalism in 1776 with “An inquiry into the Nature and Causes of the Wealth of Nations”.

Alan Greenspan (on the left) is an American economist who was chairman of the Federal Reserve from 1987-2006. Adrin Wooldridge (on the right) is a British economist and journalist who wrote for “The Economist”. Wooldridge has a doctorate in philosophy and has co-written several books with Richard Micklethwait, the editor-and-chief of Bloomberg News. One might argue Greenspan has a conservative bias but Wooldridge’s experience as a British journalist gives one a sense of balance in this informative and well-written history of American capitalism.

Smith’s concept of capitalism advocated leaving economic decisions to market forces, tempered by individual economic decision makers. What Greenspan and Wooldridge infer is that decision-makers’ discretion and interference are what roils capitalism’s history.

“Capitalism in America” reveals tumultuous times for the American economy but with positive forward momentum. The public in all countries have experienced hard times from market forces. Some countries, like Israel, India, and the U.K. have experimented with socialism as an alternative to capitalism. Communist countries like Russia and China flirt with capitalism and one may argue–benefited from its market results. The author’s history shows capitalism as the primary reason for America’s economic growth and success. However, that’s getting ahead of their story.

The authors begin at beginning with the story of Jefferson’s desire to emphasize agriculture as the primary driver of economic growth in America. In contrast, Alexander Hamilton believes the industrial revolution demands a broader view of economic policy. The key to tapping into the industrial revolution required capital which Hamilton clearly recognizes. Hamilton recommends the creation of a national bank. Hamilton is inspired by Great Britain’s Bank of England. It offered private capital and paper credit to businesses and entrepreneurs.

Hamilton, as Secretary of the Treasury, presented a “Report on a National Bank” to President Washinton and the House of representatives in 1790. This report notes that Congress, with its authority to collect taxes, could fund the bank and lend money to the government to pay foreign creditors, public services, and private businesses to grow the economy. Jefferson opposed the idea, but Hamilton’s broad interpretation of the Constitution allowed his idea of a national bank to be created. In 1791 the First Bank of the United States is established in Philadelphia and remained chartered for 20 years. This became a giant step for America’s economic growth.

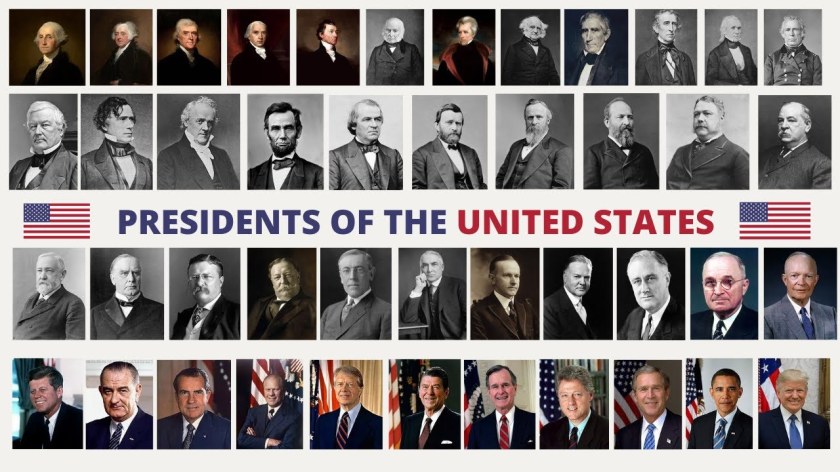

Several future Presidents opposed an American national bank. Of course, Jefferson was one because of his belief in an agrarian future for America. Jefferson’s friend and future President, Madison (the 4th President of the U.S.) opposed the idea of a national bank, and Andrew Jackson (the 7th President of the U.S.) used his power as President to oppose the “Second Bank of the United States” in 1833.

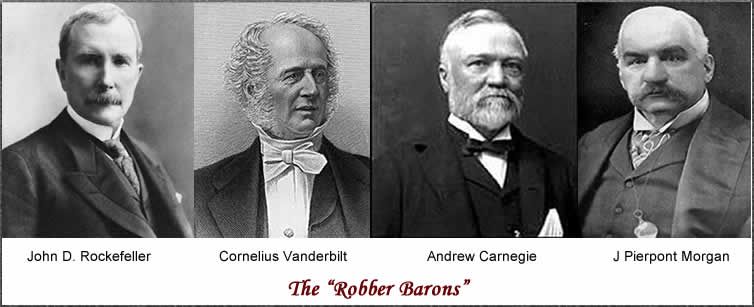

The authors note the successful industrialists of the 19th century capitalized on Hamiltonian creation of an American banking system. They became known as the robber barons of America. Rockefeller, Vanderbilt, Carnegie, and J.P. Morgan used capital to produce oil, expand rail transportation, make steel, and provide bank capital to grow the economy.

And then, WWI drew America into events that roil the course of its economic history.

An American economic boom occurs in the first two years of the war with America choosing neutrality. Exports surged from $2.4 billion to $6.2 billion in 1917. Everything from cotton, to wheat, to automobiles, to food, to machines were exported during those years. After joining the war, 3 million Americans were mobilized. When the war was over, the world and the American economy faltered. Recession (1918-1921) hit the world after the war, though America showed it had become a major world power.

As America recovered from WWI, their prowess as a producer of goods and services led to the roaring 20s and a runaway stock market that eventually crashed at the beginning of the Great Depression (1929-1939).

The authors note President Roosevelt is a great salesman who provides relief to many Americans with government employment programs during the depression. However, the authors note Roosevelt’s inept management delays America’s recovery by instituting price controls that distort market forces. Overt price control is a recurring mistake of national economies. The authors are not saying that price control is a singular cause of America’s continuing economic crisis, but it makes market recovery more difficult and longer to achieve.

The authors explain reparations for WWI’s winners helped set the table for WWII.

Germany’s inability to pay reparations, the growth of Antisemitism, and German inflation led to the rise of Hitler. Though not addressed by the authors, Japan felt threatened by American, Chinese, and Russian influence in Asia that led to Pearl Harbor and America’s entry into WWII.

The point is made that America’s depression before the war is not cured by Roosevelt’s economic intervention. The advent of war mobilized American industry.

The authors suggest market interference delayed recovery from the Great Depression. On the other hand, Roosevelt gave hope to the country with his speeches and employment programs. Citizens underlying faith in America’s ability to overcome hardship, and their response to Pearl Harbor reinvigorated the economy. Industries were retooled to meet the demands of war.

The authors argue mistakes in America’s capitalist history have been made by both Democratic and Republican Presidents who interfered with naturally occurring market forces. From Roosevelt to Nixon to Reagan to Obama to Trump, Presidents who institute price controls and/or tariffs interfere with free trade. America’s capitalist economy suffers from those actions. This is not to argue all legislation and federal action on the economy constitutes capitalist interference. Fundamental human rights that ensure freedom to vote, speak one’s mind, practice one’s own religion, work in industries one chooses, while seeking peaceful resolution of differences, are interferences that sustain capitalism.

When natural market forces are interfered with by business leaders and public legislators, capitalism suffers. An inference one may draw from the authors is that legislated programs that aid Americans who are unable or unwilling to participate in the capitalist economy are an interference with capitalism. That raises legislated issues of emigration, social security, health insurance, education, defense, transportation, veteran’s benefits, housing, environmental protection, occupational safety, and other public benefit programs. This is where there is continuing disagreement among Americans. These are not party issues because both Republican and Democratic leaders have both positive and negative arguments for and against these policies.

There is the law of unintended consequences that plague government policies. Some argue Reagan reinvigorated the American capitalist economy by reducing taxes, cutting government programs, reducing government employment, and busting union strikes. He did those things and government debt skyrocketed to a level greater than ever in the history of America. The gap between rich and poor was set on a path that beggared the poor and enriched business managers without comparable enrichment of labor. Like Roosevelt, Reagan sold ideas that had unintended consequences that were not in the long-term interest of Americans.

How can one measure the success of capitalism versus other economic systems? The author’s history of capitalism offers no answer but reveals what has benefitted and damaged American society since 1776. They illustrate failure of capitalism is in the hands of American leaders. Capitalism’s improvement is not a partisan issue but a social imperative for both Republicans and Democrats to work together to benefit all Americans.

One thought on “CAPITALIST’ LESSONS”