Books of Interest

Website: chetyarbrough.blog

“Apeirogon” (A Novel)

By: Colum McCann

Narrated by: Colum McCann

Colum McCann (Author, Irish writer living in New York.)

At first the idea of an Irish author writing a book about Israel seems incongruous. After the first few paragraphs, one realizes Colum McCann grasps a truth about religious conflict that is far better than most because of Ireland’s “Troubles” between the 1960s and 1990s.

“Apeirogon” is timely novel in regard to Israel’s response to the October 7 Hamas attack in Gaza. A little history helps one understand the complexity and terrible consequence of the slaughter of innocents.

An estimated 30,228 people have been killed in Gaza, 12,000 of which are thought to be Hamas combatants.

Gaza dates back to Egyptian times, populated by Canaanites who share an ancestral connection to Israelites. Gaza later became part of the Assyrian Empire in 730 BC. Assyrians intermixed with Canaanites, Israelites, Philistines and undoubtedly Palestinians. History shows historical connection between ancient Assyrians and Palestinians just as there were with Israelites. However, Israelites were forcibly relocated to Assyria from the Kingdom of Israel. Because the Israelites were descendants of the Canaanites, they predated Palestinian settlement in Gaza. Ethnic precedent and the want of land area is a part of what complicates the idea of a separate Palestinian state. Where is a homeland for a Palestinian state going to come from?

McCann chose a perfect title for his novel. An apeirogon is a geometric shape that has an infinite number of sides; just like the many sides of Israeli/Palestinian arguments for a homeland. Column McCann cleverly explores these arguments in his novel. He creates a series of Israeli/Palestinian incidents that show how each ethnic culture believes and acts in their perceived self-interests. Every chapter is titled as a series of numbers that begin with the number 1, jumps from 500 to the number 1001; then jumps back to 500 and descends to number 1 to end his story. Revelation comes in 1001. Occupation is an evil that cannot stand.

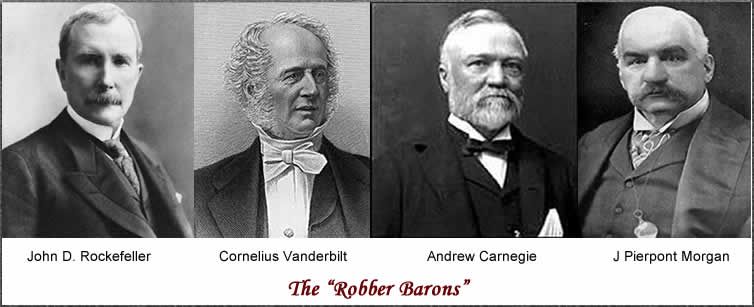

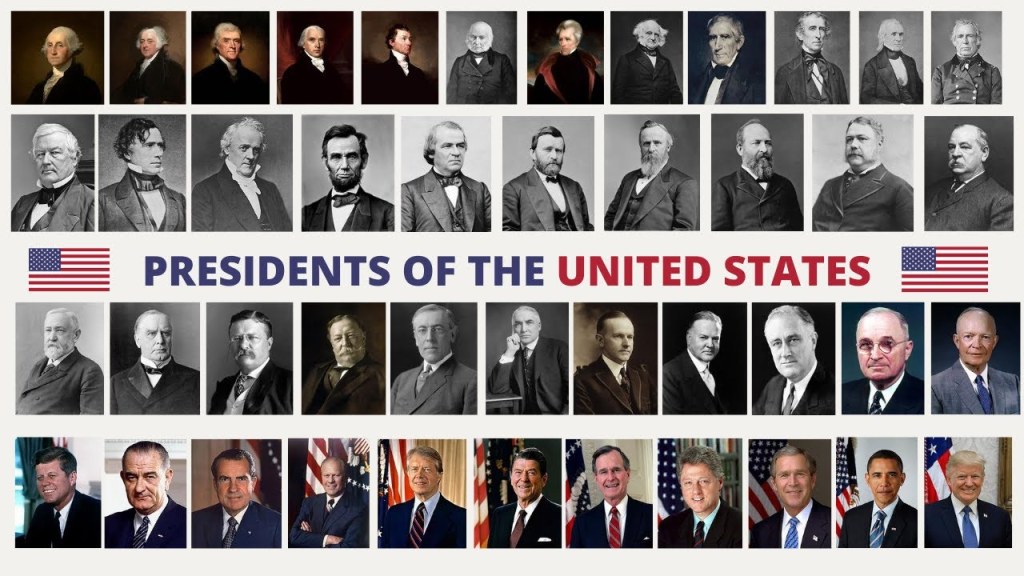

America’s civil war carries some parallels to what is happening in Israel and Gaza.

What is revelatory about McCann’s novel is its similarities to America’s civil war that ended the lives of too many Americans. Today’s conflict in Gaza is instigated by Hamas just as the Civil War was instigated by southern slave holders. America eventually forgave southern slave holders, but Black Americans continue to suffer from institutional racism. Can a one state solution as demanded by Israel’s conservatives serve Palestinians any better than white America has served Black Americans? America’s civil war ended in 1865-1866, some 158 years later, Black Americans are still discriminated against. Can Palestinians wait more than 158 years to have equal rights in an Israeli nation?

McCann’s novel repeats, too many times, the unfairness of Israel’s occupation of Gaza. Hamas has its rebellious leaders like America had John Brown who killed one Marine, wounded another, and killed six civilians. Neither Brown nor the Hamas leaders can justify their murders though both argue with righteous conviction. The United States could have split between abolitionist and non-abolitionist states, or they could move toward reconciliation. Obviously, the U.S. government prevailed with reconciliation. It seems imperative for Israeli and Palestinian leaders to take the same road as Abraham Lincoln. Hamas is a splinter group like that led by America’s John Brown. Their objective is as horribly misguided as Brown’s. Hamas’s hostage taking and murder of Jewish settlers is as reprehensible as Brown’s murders of a Marine and six civilians.

As difficult as it may be, a two-state solution seems unlikely. What American history suggests is as difficult as America has found reconciliation to be for white America’s murder and unjust treatment of Black Americans. That reconciliation remains a work in progress. However, only union offers a way toward peace. America is not there yet but it is making progress.

Two political factions, bound by both religion and ethnicity, must learn to live with each other for peace to be achieved.

There is no other land for Palestinians. Israel may have the older of the two cultures, and both Israelites and Palestinians have a much longer history of religious and ethnic difference than America. America is founded on religious freedom and equality, though not perfect in either principle. In contrast, religion is a primary determinant in Palestinian and Israeli cultures while equality seems a less prominent concern. Peace will not come without hardship, but a beginning is dependent on Israel’s abandonment of occupation. It will be one country’s leaders’ imperative to provide equal opportunity for all its citizens. The struggle will be long as is shown by America’s history but what realistic alternative is there for the Israeli and Palestinian people? What neighboring country is likely to give up their land to create a two state solution?

“Apeirogon” is a little too repetitive for this reviewer, but it is cleverly written and shows why political and military occupation is a fool’s leadership style. Israel, like white America, needs to do better in reconciling ethnic differences.