Books of Interest

Website: chetyarbrough.

Great Courses-Understanding Japan (A Cultural History)

By: Mark J. Ravina

Narrated By: Mark J. Ravina

Mark Ravina (Scholar of Japanese history at the University of Texas at Austin)

Professor Ravina’s lectures are a little too heavy on Japan’s ancient history but offers some interesting opinion about the rise of the Samurai, the evolution of women’s roles in Japan, Emperor Hirohito and his role in WWII, the democratization of Japan after WWII, and the cause of Japan’s current economic stagnation.

As is well known, the Samurai were a warrior class in Japan. Their role in Japanese history grows between 794 and 1185.

They began as private armies for noble families with estates in Japan. They became a force in Japanese politics and have had an enduring effect on Japanese society. They evolved after 1185 into a ruling military government called shogun that exhibited political influence through 1333, emphasizing Bushido or what is defined as a strict code of loyalty, honor, and discipline. That discipline extended to ritual suicide in defeat or disgrace to preserve one’s honor. Zen Buddhism entered into the Samuria culture, exhibiting a time of peace under the Tokugawa shogunate that lasted until 1868. After 1868, the Samurai era came to an end, but its cultural influence remains in a modernized military that adheres to qualities of discipline, honor, and resilience.

Traditional Japanese Woman.

The role of women in Japan has evolved from great influence and freedom for the well-to-do to a life of restricted domesticity.

During the Samurai era, the influence of women declined and became more restricted. The rise of Confucian ideals emphasized male dominance with women being relegated to domestic duty. Women turned to art, calligraphy, and religion as their societal influence decreased. In the Meiji Era (1868-1912) women’s education somewhat improved and they began to participate in political movements like voting and equal rights. Finally, after WWII, a new constitution granted women equal rights like the right to vote and enter the workforce. However, like America, traditional gender roles persisted. In today’s Japan, like most of the world, equal rights remain a battle for women.

Hirohito is the 124th Emperor of Japan.

He reigned from 1926 to 1989. Professor Ravina notes that a question is raised about whether the emperor was a follower or leader in Japan’s role in WWII. Ravina argues history showed Hirohito’s role was as a leader. In defeat, Hirohito renounced his divine status to become a constitutional monarch under U.S. occupation. Hirohito, as the crown prince of Japan, strengthened Japan’s diplomatic ties on the world stage. He was instrumental in scientific research in marine biology. He emphasized Japan’s drive to become an industrial nation and player in international trade. He militarized Japan in preparation for war and territorial expansion. He authorized invasion of Manchuria in 1931 to establish it as a puppet of Japan. Hirohito aids the American occupation, after WWII, to de-militarize and re-industrialize Japan.

With creation of a new constitution for Japan in 1947, Japan became a constitutional monarchy that made the emperor a symbolic figurehead, and guaranteed freedom of speech, religion, and assembly.

The constitution formally denounced war as a means of settling disputes. Land reform redistributed agricultural production to tenant farmers that reduced the power of wealthy landlords and promoted economic equality in rural Japan. Women’s rights were codified to allow voting and participation in politics. The constitution guaranteed equality but, like the rest of the world, culture trumped reality. Japan’s military was reorganized as a defensive force for national security. War crimes trials convicted Hideki Tojo, Iwane Matsui, Hei taro Kimura, Kenji Doihara, and Koki Hirota and sentenced them to death. In total 17 leaders were executed, and 16 others were imprisoned.

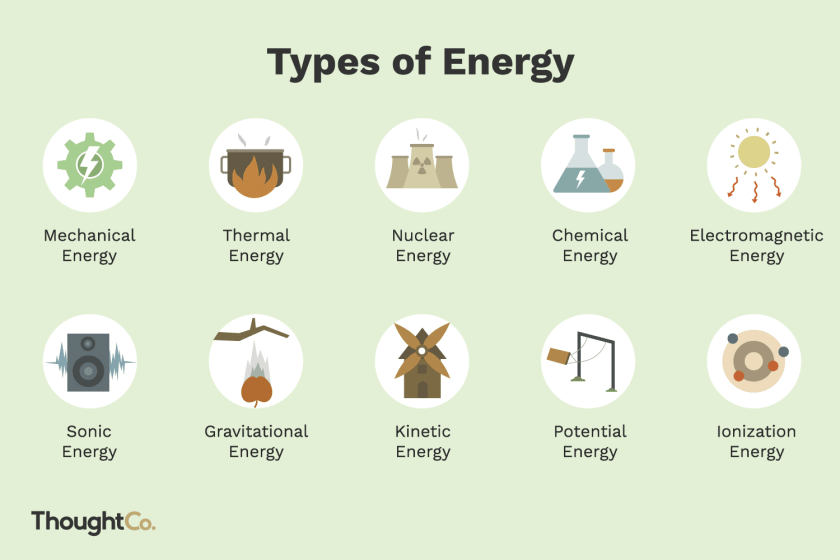

Free-market economy.

The democratization of Japan entailed economic reforms that broke up large industrial conglomerates to promote a free-market economy and reduce economic monopolies. However, the culture of Japan replaced the industrial conglomerates with networks of interlinked companies that operated cooperatively in ways that reduced competition in pursuit of financial stability. The education system was reformed to promote democratic values, and equal access to education for all citizens.

A free press was encouraged to foster transparency and accountability.

The results allowed Japan to rapidly improve their industrial productivity. That productivity was defined and improved by the teachings of W. Edwards Deming, a statistician and quality-control expert in the 1950s. His contributions led to the Deming Prize in 1951, an annual award recognizing excellence in quality management. (This is a reminder of Peter Drucker and his monumental contribution to business practices in the United States.)

In Ravina’s final lectures, he addresses the economic stagnation that has overtaken modern society in Japan.

It began in the 1990s. A sharp decline in asset prices wiped out wealth and triggered a banking crisis. Banks had made too many bad loans that became non-performing. Deflation ensued with falling prices that discouraged spending and slowed economic growth. Company profits declined. The demographics of Japan reduced the size of the work force because of an aging population and declining births. One suspects this demographic change is further burdened by ethnic identity that mitigates against immigration.

Japan’s consumption tax increases in 1997 impeded recovery.

The close ties between government, banks, and corporations resist reforms. And, as is true in America, global competition from other countries with lower cost labor eroded international trade.