Books of Interest

Website: chetyarbrough.blog

How Economics Explains the World (A Short History of Humanity)

By: Andrew Leigh

Narrated By: Stephen Graybill

Andrew Leigh (Author, Australian politician, lawyer, former professor of economics at the Australian National University, currently serving as Assistant Minister for Competition, Charities and Treasury and Assistant Minister for Employment in Australia.)

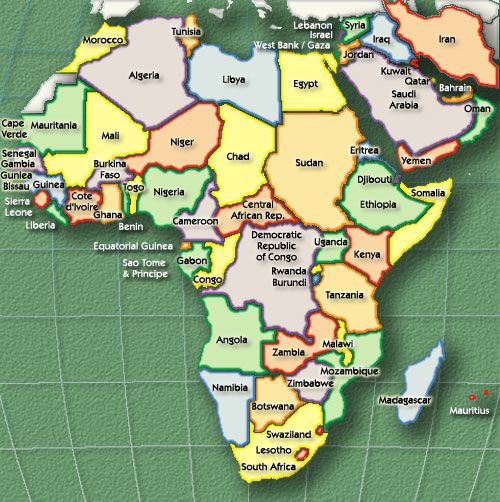

Andrew Leigh offers a bird’s eye view of the history of economics. He provocatively explains why the European continent, rather than Africa (the birthplace of the human race) came to dominate the world. He suggests it is because of economics and the dynamics of the agricultural revolution.

Because Africa offered a more conducive environment for natural food production, Leigh infers natives could live off the fruits and nuts of nature. He infers farming and agricultural innovations (like the plow) were of little interest to Africans.

One may be skeptical of that reasoning and suggest the primary cause is sparse arable land for early African inhabitants. Without arable land, there was little advantage from the agricultural revolution.

Nevertheless, Leigh’s history is a wonderful reminder of great economic theories that improved the lives of an estimated 8.2 billion people on this planet. He touches on the lives of Adam Smith, David Ricardo, John Maynard Keynes, and Milton Friedman. Each made great contributions to the history of western economics.

Adam Smith is considered the father of modern economics. (1723-1790)

Leigh notes Smith was a deep thinker who sometimes neglected the world he lived in by forgetting to properly dress himself or falling into a hole while thinking about economic theories. Some of his key theories were “Division of Labor”, the “Invisible Hand”, “Labour Theory of Value”, “Free Markets and Competition”, and “Capital Accumulation”; all of which remain relevant today. One that seems so important today is “Free Markets and Competition” and the disastrous idea of tariffs that are being promoted by the pending Trump administration.

Smith notes natural resources are not equally distributed in the world. Some countries have more raw material than others, more available labor at a lower cost, and can produce product at lower prices. With free trade, all citizens of the world are benefited by lower costs of goods. With tariffs, product costs are artificially increased when they could reflect actual costs of production. Of course, the producer can increase costs, but the market will find an alternative if the costs become too high.

David Ricardo (1772-1823)

Ricardo’s theory of competitive advantage suggests some countries can produce product at less cost than others. This reinforces the critical importance of free trade. Free trade flies in the face of both the Biden’s passing administration and Trump’s future administration; both of which believe tariffs protect jobs in America. They don’t; because tariffs artificially increase product costs while protecting labor inefficiency that increases consumer prices. Tariffs are a lose-lose proposition. It may affect jobs in the short term but there are many jobs that can be created by government and private companies in human and public service industries. Those investments would offset inefficient product production and ensure future jobs.

John Maynard Keynes (1883-1946)

Leigh notes that Keynes was bisexual and a pivotal figure in modern economics. He believed in the theory of Aggregate Demand meaning that “…spending in an economy is the primary driver of economic growth.” He advocated government intervention when demand was low, and that government should increase spending and cut taxes to increase demand when a recession or depression threatens the health and welfare of the public. Interestingly, Trump believes in reducing taxes but objects to government spending that improves employment. The effect of reducing taxes only increases income inequality and does little for employment because the rich are wary of investing in a weakening economy.

Milton Friedman (1912-2006)

Both Keynes and Friedman believe in government intervention, but Friedman exclusively believes in using only monetarism as a tool. Keynes agrees but had the added dimension of government spending that creates jobs. In contrast, Friedman argues there is a natural rate of unemployment and when government intervenes it creates inflation. He strongly agreed with free markets which suggests he would be against tariffs but at the expense of higher unemployment. The cloying part of that argument is it increases income inequality by making the rich richer, the unemployed and middle-class worker poorer.

Leigh’s book is a brief review of western economics. It glosses over much of the science, but it is highly entertaining and worth listening to more than once. Additionally, Andrew Leigh’s brief history of economics reminds listeners of a threat America faces in the next four years.