Books of Interest

Website: chetyarbrough.blog

“The Economists’ Hour: False Prophets, Free Markets, and the Fracture of Society“

By: Binyamin Appelbaum

Narrated by: Dan Bittner

Binyamin Appelbaum (Author, winner of a George Polk Award and a finalist for the 2008 Pulitzer Prize, lead writer on economics and business for The New York Times Editorial Board)

Binyamin Appelbaum has written an interesting summary of a difficult but immensely important subject. Economic policy and theory are boring, but they touch every aspect of life. Appelbaum shows economic policy magnifies or diminishes the welfare of every American, let alone every economy in the world.

Adam Smith’s foundational theory of economics.

Though only briefly mentioned by Appelbaum, American economic policy begins with Adam Smith (1723-1790), the Scottish philosopher who wrote “The Wealth of Nations”. Smith advocated free trade and argued against parochial maximization of exports and imports that is manipulated by strict governmental regulation meant only to accumulate gold and silver.

Appelbaum illustrates how American policy violated the entrepreneurial freedom that Adam Smith advocated. In contrast to Smith, John Maynard Keynes (1883-1946) advocates government intervention whenever there is an economic downturn. Equally interventionist is Milton Freidman’s (1912-2006) belief that government should increase or decrease the money supply for national economic stability. The point seems to be that every economist thinks they have a magic bullet that will cure the ills of a faltering economy.

To be fair, Friedman did believe in free enterprise in regard to nation-state currencies. He argued for a floating currency rate that ultimately led to President Nixon’s abandonment of the gold standard. However, the nature of human beings led to speculation and manipulation of nation-state’ currencies that exacerbated trade tariffs and defeated the policy’s free-enterprise objective.

One concludes from “The Economists’ Hour…”, there is no magic solution for an economy in crises. Neither Franklin Roosevelt, George W. Bush, Barack Obama, or any American President cured what ails an American economy that succumbs to economic crises. Adam Smith would argue an economic crisis is caused by a governments’ interference with free enterprise.

Applebaum explains how every 20th and 21st century President of the United States placed their faith in economists’ economic assessments of their day. All Presidents have found intervention by the government has unintended consequences.

President Nixon adopted Freidman’s monetary policy by imposing a freeze on prices and wages that squeezed the life out of the business economy and beggared the wage-earning public with job loss.

A decade of stagflation (high inflation and slow growth) followed Nixon’s administration. Stagflation is attacked by the Reagan administration with mixed results. A myth from economists like Arthur Laffer grew in 1974. Laffer believes taxation is either too high or too low for any benefit to society. Laffer argued zero tax and maximum taxation are equally harmful and produce economic stagnation and/or collapse.

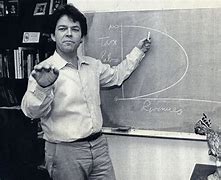

ARTHUR LAFFER (American economist and author, served on President Reagan’s Economic Policy Advisory Board 1981-1989, Here illustrating the “Laffer Curve”.)

Laffer argued every government that reduces tax revenue decreases the stimulative effect of government spending. On the other hand, he suggested every tax cut increases income for taxpayers that will stimulate business and increase employment while encouraging higher production. He laughably created the “Laffer curve” to imply there is an optimum balance of tax reduction that would stimulate economic growth with proportionate increases in government revenue to provide for better government services. That balance has never been found. President Ronald Reagan experimented with Laffer’s idea, but it fails from unintended consequences. The principal consequence is to increase the gap between rich and poor.

BENEFIT OF TAX REDUCTION

Reagan accelerated a movement for government tax reduction that ultimately reduced income taxes from 70% to 28%. The result of government tax reduction during the Reagan years increased the U.S. budget deficit from $78.9 billion to $1.412 trillion. The benefit of that tax reduction went to the wealthy while school lunches were cut, subsidized housing declined by 8%, and poor families lost $64 a month in welfare payments. In 2023, the budget deficit stood at $1.70 trillion, an imbalance that shows why the “Laffer curve” is sardonically laughable.

President Reagan’s administration (1981-1989) was influenced by Laffer’s curve.

The joke is “There is no perfect balance on the curve because of the nature of human beings.”

Roosevelt, George W. Bush, and Obama choose to follow Keynesian policy. Roosevelt bloated government employment. All three increased the government deficit.

Some suggest the idea of

“Cost benefit analysis” (CBA) is recommended to the federal government by two law professors, Michael Livermore and Richard Revesz during the George H. Bush administration but Reagan initiated it with an Executive Order in 1981.

Appelbaum notes that “cost benefit analysis” for government is first used during the administration of Ronald Reagan. However, Bill Clinton reifies its use with an Executive Order in 1993 that required covered agencies to do a CBA on “economically significant” government regulations. Ironically, Clinton was the first President in the post 19th century to balance the budget. Andrew Jackson manages to do it in his term between 1829 and 1837.

An irony of using “cost benefit analysis” is that it required a determination of of a human life’s value. Presidents Nixon, Ford, Carter, and future Presidents use value per statistical life during their administrations. High-income earners were worth $10 million to $15 million, middle-income earners $1 million to $2 million, and low-income earners $100,00 to $200,000. Of course, these values were always litigable. The point is that CBA became a tool for government to regulate the costs of government policies, ranging from military expense to the health, safety, and welfare of American citizens.

The remainder of Appelbaum’s book reflects on the experience of America, Chile, and Taiwan in the 20th century. The implication of his review of economic policy is that those countries that align with the free enterprise beliefs of Adam Smith have made mistakes. However, America’s, Chile’s, and Taiwan’s economic policies seem to have had more economic success when following Smith’s beliefs.

Along with CBA, Appelbaum notes the ongoing controversy is about regulation by government when it tries to balance American health, education, and welfare with Adam Smith’s concept of free enterprise. Appelbaum infers no American President has found the magic formula for balancing the needs of its citizens with the concept of Adam Smith’s free enterprise.

3 thoughts on “WHO’S LAUGHING”