Books of Interest

Website: chetyarbrough.blog

This Time is Different (Eight Centuries of Financial Folly)

Author: Carmen Reinhart, Kenneth Rogoff

Narration by: Sean Pratt

Carmen Reinhart (on the left) is a Cuban American economist and Professor of the International Financial System at Harvard Kennedy School of Business. She has a Ph.D. from Columbia University. Kenneth Rogoff is an American economist and chess Grandmaster who received a B.A. and M.A. from Yale and a PhD in Economics from MIT.

Two well educated academics try to explain why world economies are not unique by arguing the patterns of financial crises are similar, if not identical.

They argue heavy borrowing, inflated optimism, bank collapses, high inflation and currency devaluations are common characteristics of nation-state financial crises. These nation-state government actions and reactions are a result of innate human behaviors. They argue recurrent financial crises feed off of each other to spread economic chaos that creates panic among economic movers and shakers of national economies.

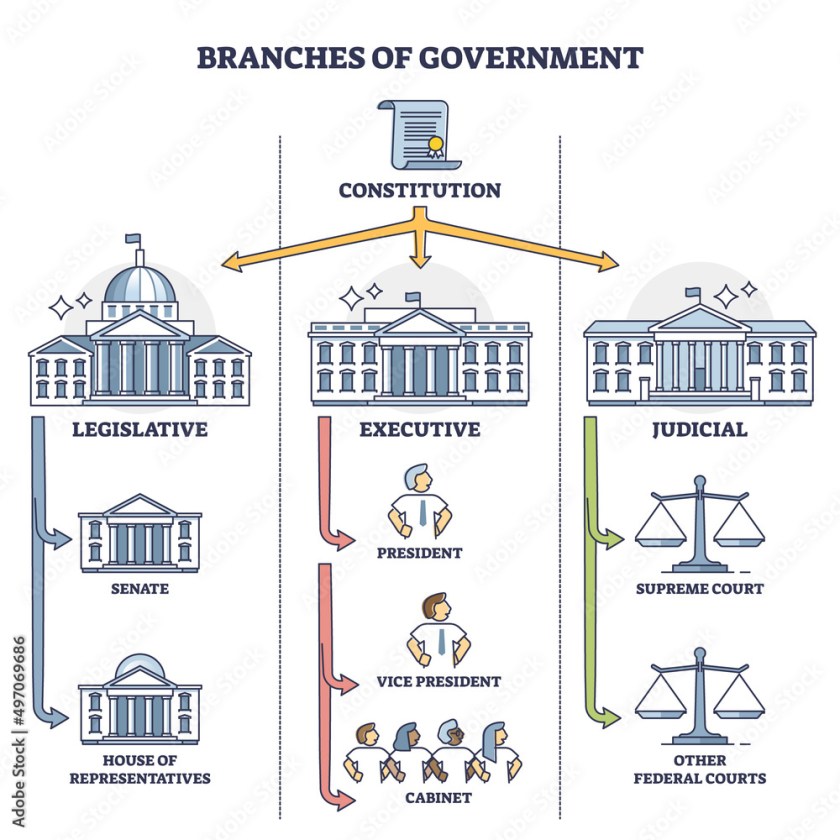

Our American government.

The importance of Reinhart’s and Rogoff’s observation is particularly interesting in light of the economic disruptions of the current American government. History shows America is not exempt from economic crises. In 2008’s economic crises America carries a large responsibility for itself and other nations near collapse. The 2008 economic crisis shows how domestic debt can threaten the world, let alone one country.

Maybe American government is not above the law, but a President shows he is capable of bending it.

In light of Donald Trump’s directed tariff war and his “…Big Beautiful Bill Act” that eliminates federal income taxes on Social Security, tips, and overtime pay, America’s national debt is likely to balloon. He is gambling American citizens’ future on belief that tax reductions will be offset by economic gains from improved industrial development. This is at a time when industrial development is being impacted by arbitrary firing of government employees, AI innovations that reduce employment, and industry employees retiring or transitioning to a service economy that pays less livable wages.

Trump’s tax policy will continue its top tax rate at 37% despite the government’s earlier intent to have it revert to 39.6%.

The effect of these tax policy changes is expected to reduce tax revenues by 4 to 5 trillion dollars at a time when America’s debt has never been higher. It is estimated at $38 Trillion dollars today. America’s interest rate on that debt is 3.393%, more than double the rate of five years ago. The increasing rate is related to the believed risk of U.S. default which will most likely rise with Trump’s tax breaks. U.S. debt has never been higher. Interest at its present rate will consume 14% of the federal government’s outlay in 2028. That 14% could help pay for the Affordable Care Act that is opposed by the Republican majority. The Trump tax policy implies continued heavy borrowing, an inflated optimism that threatens bank collapses, high inflation, and currency devaluations. Though the authors are not writing that America is on the verge of economic collapse, their observations infer a crisis is nearing, if not inevitable.

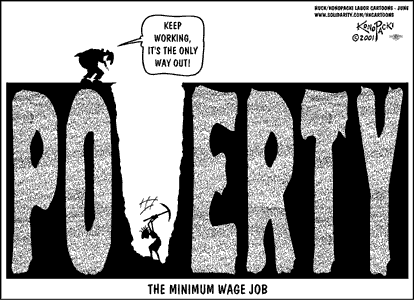

Capitalism should be designed to ameliorate the wealth gap, not exaggerate it to the point of people going hungry in one of the richest countries in the world. Capitalism is the greatest economic system in the world, but equality of opportunity remains a work in progress that is made worse by poor government policies and the inherent faults of human nature.