Blog: awalkingdelight

Website: chetyarbrough.blog

“The Golden Passport: Harvard Business School, the Limits of Capitalism, and the Moral Failure of the MBA Elite”

By: Duff McDonald

Narrated by: George Newbern

Duff McDonald (Author, Canadian American, University of Pennsylvania graduate in Finance.)

“The Golden Passport” explains how Duff McDonald believes America got to today’s state of income inequality. McDonald argues that inequality is largely created by one education system, Harvard Business School, founded in 1908. According to a team of academics that publishes “Academic Influence”, HBS produces most of the Fortune 500 companies’ CEOs. With an estimated 70,000 HBS alumni, there is some merit to McDonald’s argument, but the fundamental cause is not education but human nature.

The extent of HBS’s impact on business practices certainly has influence on business leaders and teachers around the world. This is a similar argument made by William Deresiewicz in “Excellent Sheep” about America’s political leaders and administrators who were educated in exclusive ivy league universities.

Both authors suggest Ivy league universities are turning out management automatons that tend to think inside the same box, i.e., a mind-set that perpetuates income and power as the primary motivations of those who manage the business economy. Both authors argue Ivy league’ graduates permeate the management structure of the largest businesses and most powerful political offices in the world. The graduates of the Ivy league have common backgrounds and education with predictable answers for thought and action that have accelerated and reinforced income inequality in America.

Ayn Rand (1905-1982, Russian-born American writer and philosopher associated with capitalist’ self-interest. Though not educated at Harvard, Rand is considered a philosophical precursor to a belief that one should have liberty of thought and action, i.e., the libertarian view of society.)

Though HBS may be a promoter and reinforcer of income inequality, it is only an influencer of what makes humans acquisitive. The majority, if not all humans, are self-interested. Though self-interest varies among individuals, wealth is power–particularly in capitalist countries. The more money one has the more freedom and independence accompanies their lives.

McDonald’s point is that the HBS’s business model focuses on profitability as the only measure of business success. Because of that focus, business executives myopically view workers as a cost rather than source of company profitability. By reducing worker costs, executives are rewarded with uncapped compensation policies.

Business decisions are always made without knowledge of all information needed to direct an organization’s actions.

The case study method of education, pioneered by the Harvard Business School, focuses on profitability as the primary, if not singular, goal of a business enterprise. Efficiency becomes the mantra of business management which discounts, often ignores, workers’ compensation within corporations. By focusing on profitability, there is a point of diminishing return because of its impact on workers’ motivation. Pressing for higher productivity and reducing labor costs have diminishing rates of return that are not taken into account by CEOs interest in cost cutting. CEOs are incentivized to choose efficiency over worker welfare and productivity.

Robert McNamara (U.S. Secy. of Defense in the Kennedy administration.)

The real-world example McDonald uses to make his point is the war in Vietnam and the role of U.S. Secretary of Defense, Robert McNamara. McNamara is a Harvard graduate that by any measure was a brilliant student. He outclassed most of his business class students in his ability to bolster arguments with recalled information that most would have to look-up to use as part of their policy decisions.

Henry Ford (1863-1947, American industrialist and business magnet who founded Ford Motor Company.)

McNamara accepted the Controller’s job at Ford Motor Company when Henry Ford’s son took over the company. His education at Harvard led him to focus on efficiency as a primary tool for improving the business performance of Ford. His drive for efficiency is based on reducing costs of labor and material while increasing automobile production.

McNamara developed what became known as the “Whiz Kids” of management that carried out his drive for efficiency to increase corporate profits.

By the measure of profitability, the “Whiz Kids” were extraordinarily successful. The drive for efficiency increased corporate officer salaries because of corporate profits. What is not taken into consideration is that it disproportionately depressed worker compensation increases. The long-term worker’ effects were not part of the “Whiz Kids” concern; in part because those effects are difficult to measure. There are many reasons why Ford’s profits fell after McNamara left the company, but McDonald implies an underlying cause is Ford’s penchant to address worker income as only an efficiency measure. Ford loss of profit rises in the early 1970s and reaches $2.3 billion in 1991.

McNamara became Ford’s General Manager in 1949 and served as President in 1960. He left Ford in 1961 to become President Kennedy’s Secretary of Defense.

McDonald writes that McNamara’s experience at Ford led him to believe statistical analysis is the only basis upon which success may be measured. That focus discounted human intensity of belief in the political cause of the Vietcong. American superiority on the battlefield could not defeat Vietcong political intensity. McDonald’s point is that a CEO who looks at employees as only cost centers rather than humans with a social underpinning will eventually cause business failure.

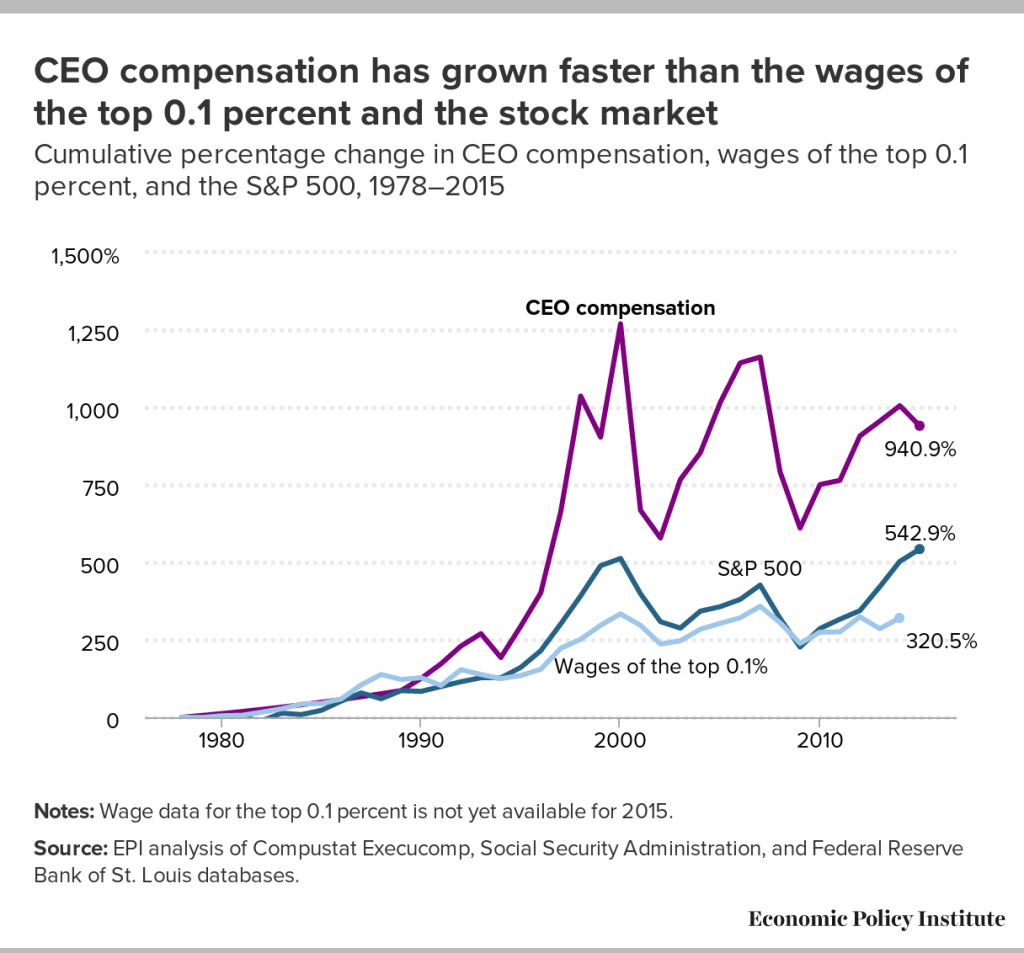

The difficulty is in measuring worker social impact on performance. A CEO is unable to make rational decisions about employee compensation without better understanding of workers’ needs. With CEO emphasis on corporate profits, the inclination is to either to ignore or minimize workers’ compensation when making business decisions. The end result is to widen the compensation gap between CEO pay and most employees of the company. McDonald argues the 1970s became the beginning of a pig feeding for corporate CEOs that has only accelerated with further influence by HBS’ education changes.

McDonald explains how business education at Harvard created a self-perpetuating engine for CEO salary acceleration with HBS Directors like Michael Porter who created the Five Forces Framework. The Five Forces Framework is a statistical analysis of the competitive environment of specific industries. By using that analysis, business mergers and divestiture decisions could be made based on profitability.

The net effect certainly increased business profits but minimized employee enrichment while multiplying CEO compensation.

The Five Forces Framework led to a spate of mergers that continued to accelerate CEO compensation without commensurate salary increases or, in some cases, continued employment of workers.

Before beginning “The Golden Passport”, one might think the unconscionable incomes of CEOs of large corporations is a moral, not pecuniary, observation. However, CEO’s pay in relation to salaries of working men and women is not about morality. It is about money, worker employment, and the work contribution a motivated worker offers to business. There are many variables to the profitability of a corporation with a CEO’s contribution being management judgement, time, and skill. The argument based on morality ignores the truth that one person’s role as CEO cannot be justified when it is 300 to 400 times the annual salary of a worker (an estimate noted by Statistica, a global analytics software package).

How can any human being be worth 30 to 40 million dollars a year–even if he/she is expected to work every hour of a 24-hour day as a CEO? McDonald suggests HBS’ educated CEOs press for short term profitability because it offers outsize rewards for their performance. Workers are laid off when mergers occur and they never receive compensation increases equal to bonuses paid CEOs.

McDonald goes on to give many examples of the evolution of HSB curriculum for students. The emphasis remains based on statistical analysis of profitability because it is an easily measurable criterion. Corporate performance improvement, whether it is improved profit or an industry’s ability to stay in business, CEOs and their Boards need to compensate workers equitably.