Audio-book Review

By Chet Yarbrough

Blog: awalkingdelight

Website: chetyarbrough.blog

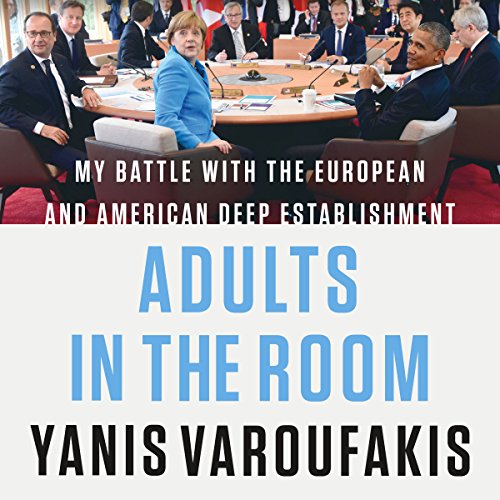

Adults in the Room (My Battle with the European and American Deep Establishment)

By: Yanis Varoufakis

Narrated by: Leighton Pugh

Yanis Varoufakis (Author, Greek economist and politician, Minister of Finance of Greece for 7 months in 2015, launched Diem25, the “Democracy in Europe Movement 2025” in February 2016.)

Yanis Varoufakis gives listeners a glimpse of decisions made when a national government is compelled to declare a national debt crisis. To fairly understand “Adults in the Room”, one will struggle with Varoufakis long story. His story is about restructuring rather than refinancing the debt owed the E.U. and IMF for a national debt crisis. Restructuring debt changes terms of repayment based on an original debt, while refinancing increases the debtor’s burden.

It is helpful to have listened to a book about Detroit’s bankruptcy. Detroit’s harrowing experience gives some idea of how difficult it is for a government entity to repay creditors for profligate government economic management. Detroit manages to restructure their debt with the help of its citizens. Greece is caught in the grips of E.U.’ and IMF’ bureaucracy that only increases its debt.

Varoufakis’ argument for understanding the plight of society’s poor is highly relevant in this era of democracies’ homelessness and economic inequality.

Varoufakis acknowledges socialist beliefs while inferring a negative opinion about capitalism. Varoufakis professes strong belief in democracy with a pronounced lean toward socialism, i.e., a belief similar to America’s Bernie Sanders who is mentioned in “Adults in the Room”.

Varoufakis notes that Greek, like American society, is unequal with rich and poor being disproportionately benefited by intended and unintended government and economic policy.

Greek government’s effort to compensate for inequality seems couched in an economic system meant to equalize citizen inequity with a pension system designed to compensate the poor for economic inequality. A poorly managed national economy and a weakly enforced tax collection system compounds Greek government failure to live within its means.

When Greece declares a sovereign debt crisis, the European Union and the IMF (International Monetary Fund) provide a credit lifeline of $9.5 billion to avoid a default on a previous bailout.

This so-called lifeline is contrary to what is requested by Varoufakis who becomes the Minister of Finance for Greece. The benefit of restructuring the debt provides liquidity to the Greek banking system without theoretically damaging credit worthiness of either the E.U. or IMF. On its face, it seems a win-win solution for Greece’s debtors and Greece’s citizens. However, the E.U. sees it as a dangerous alternative that fails to address the root causes of Greece’s profligate behavior. The E.U. demands control of all economic expenditures of the Greek government in return for a bail-out of past debt with a larger tranche of new debt. Financial control of Greece’s use of the new funds is to be exercised by a triumvirate representing the debt holders.

Varoufakis asks that Greece’s original bailout debt be restructured as a long-term bond with reduced payments over a long period of time, with payment size largely determined by Greece’s liquidity in a recovering economy.

In contrast, the demands of the E.U. and IMF are that salaries and pensions be cut, government employees’ pensions frozen, and retirement age raised. Those measures disproportionately hit the poor, destroy jobs, do nothing to improve tax receipts, and make it more difficult for Greece to pay its debt; not to mention the strict control of all expenditures by an external triumvirate of debt holders.

With these draconian rules, Varoufakis notes unemployment improves. However, the economy is estimated to be 25% smaller; not to mention the impact of the external triumvirates’ control reduces living standards, pensions, and salaries of the working poor.

The point of Varoufakis’ story is that the E.U. and I.M.F.’s mandated terms victimizes the most vulnerable Greek citizens trying to make a living.

Varoufakis resigns after 7 months in office after unsuccessfully fighting the onerous and inequitable demands of the E.U. and IMF. In some listener’s opinion, some may suggest Varoufakis abandons the poor, but his story suggests the decision of the controlling triumvirate of the E.U. and IMF rendered his continued role as Minister of Finance a virtual joke. Varoufakis is unable to change the E.U. and IMF board’s inflexible rules. Greece’s Minister of Finance cannot achieve a delay in their demand for restructuring the Greek’s debt to correct a poorly managed tax system and weak economy that victimizes the most vulnerable citizens of Greece.

For listeners of “Adults in the Room”, one wonders where wealthy Greek citizens were when Varoufakis tries to pull Greece out of its financial ditch.

Unlike the book about Detroit’s bankruptcy, there seems no appeal to rich citizens of Greece and a method for using Greece’s historical art and artifacts to collateralize a more equitable bail out for its people. Where were the Greeks who could afford to pay their taxes? Where were the art and antiquity foundations that could have aided in the negotiations with the E.U. and the I.M.F.? The historic art and monuments of Greece are an international treasure, particularly for western culture.

In retrospect, Varoufakis’s idea of restructuring the debt seems brilliant but there seems no time is allowed for Varoufakis to organize a response that could change the mindset of the members of the E.U. and IMF decision makers. As a “Monday morning quarterback”, Varoufakis’s idea would have carried more weight if he had gathered support from wealthy Greek merchants and art foundation entities that could have created a repayment sweetener to seal his loan restructuring idea. However, it appears there was not enough time for Varoufakis to gather enough support to make a case for debt restructuring. The triumvirate controlling the purse strings of the bailout would not wait.

Listeners owe a debt to writers like Varoufakis who are willing to tell their stories, whether right or wrong. In fairness to Varoufakis, it is easy to retrospectively review his actions to save the Greek economy.

At best, one concludes, restructuring Greece’s debt was a great idea that could have achieved a decent compromise for its lenders. On the other hand, one wonders what the leaders of Greece were doing when the repayment crises first began to show itself.

There were undoubtedly some powerful and rich Greek leaders who could have come to the aid of their country in this 21st century “time of need”. One is reminded of the heroic defense of Greek citizens in Crete when Nazis invaded their strategically located island. Where were the descendants of the many great Greek heroes of antiquity?

2 thoughts on “GREEK TRAGEDY”